Source: Stuff

Getting started in farming water buffalo in New Zealand today will be about as exotic as a trip to the gas station compared with the Wills-Armstrong family’s journey of discovery to these endearing great grey creatures.

The family, who operate Whangaripo Buffalo in north Auckland, started farming water buffalo eight years ago after a quest which took them to Germany, Italy and Africa.

While water buffalo are still not exactly thick on the ground here, you could, if you fancied cashing in on the growing demand from restaurants and discerning and health-conscious food buyers for their milk, cheese and meat, buy some without taking on a tangle of import red tape. (Whangaripo Buffalo has enough animals now to sell you a complete herd.)

But when Chris and Pam Wills, their daughter Annie Wills and husband Phil Armstrong, and then-toddler son Marin, set off overseas about nine years ago, few Kiwis had ever seen water buffalo unless they happened to pass AgResearch’s Ruakura campus in Hamilton while a trial was under way.

The back story to the family’s travels and subsequent importation of 17 in-calf buffalo heifers and two bulls from Australia starts with Waikato-born Annie, (birth name Andrea) who has an agriculture degree from Massey University and worked for some time with big tented safaris in Botswana.

Her husband Phil grew up on a dairy farm at Maketu, on the Bay of Plenty coast. He went to sea straight from school and spent 17 years on deep sea trawlers and two-man fishing boats, meeting Annie in 2000. Buying the boat Phil was working on then was a stretch for the couple, so he went into the building trade.

Meanwhile Chris, an engineer in the waste industry and wife Pam, who had long farmed cattle on a small scale, were looking for a retirement business that could support the family in future.

Urged by Annie to see Africa, they set off initially for Europe where they saw buffalo being milked for Italy’s famed mozzarella cheese industry. Later it was on to Mozambique where they had thoughts of buying land and establishing a fishing business. But Chris became ill and without confidence in that country’s health system, the family came home.

Unable to afford a viable dairy or sheep and beef farm, they bought 20 hectares in the postcard-pretty Whangaripo Valley between Matakana and Wellsford, and started thinking hard about the buffalo they’d seen in Italy.

With Annie’s mantra “how hard can it be?” and a bit of research spurring them on, the family imported buffaloes from Queensland.

This involved a five month quarantine rigmarole but the rest has been easy, and the returns rewarding.

“We don’t advertise, but we sell everything we make,” says Phil.

The family’s original intention was to sell milk, recognised for its higher levels of crude protein, fat, calcium and phosphorous, and slightly higher level of lactose, compared to cow’s milk, to a local dairy company. The high levels of total solids make the milk ideal for processing into value-added products such as cheese and it can be tolerated by people allergic to dairy cow’s milk.

But they also had an eye to farming buffalo for meat. The animals don’t store fat in their meat (marbling) which has about one-third the fat content of chicken, says Chris.

What the family didn’t plan to do was make cheese – now a significant part of annual revenue.

This side of the business came about when the initial milk sales plan fell through and the family had to learn to make cheese – fast.

Today the company sells a large range of buffalo cheeses, including Marin Blue (named after Marin, now 10) and a hard cheese called St Malo, named for youngest son Malo, (who isn’t a saint, says Phil) and a brie rolled in ash called St Benedict the Black.

The company produces 6-8 tonnes of cheese a year for sale around the country as well as bottled fresh pasteurised milk and milk for other cheesemakers.

Whangaripo Buffalo prime meat – sold mostly as burgers from the herd’s R2 year bulls killed at Ruakura, Hamilton – is in demand at north Auckland’s Matakana market, organic shops in Wellington and Auckland, and top restaurants, selling for up to $40a kilogram.

While the family’s aim is never to lose the artisan food production touch, this is no cottage business.

The buffalo herd currently numbers 115 which includes 50 milking cows, 20 in-calf heifers and the remainder bulls and calves. Cows are milked once a day all year round and are producing about 6000kg of milksolids annually.

The business is operated over three properties – a leased 50ha block at Dairy Flat, on leased 20ha at Leigh Road, Matakana, and at the family-owned land at Whangaripo Valley.

The bulls and calves are farmed at Dairy Flat, where the family is living until a new house is built at Whangaripo Valley, and where cheese making is done in a converted container.

When heifers are a year old they go to the Matakana property and then on to Whangaripo Valley to join the milking herd. A bull is run with the females year round and Phil is expecting 70 to calve in the next 12 month cycle. He’s currently milking 26 cows every evening for about 80 litres of milk.

Bulls are sent for processing aged 18 to 22 months and when hooked, can weigh up to 300kg. Ruakura is one of only two buffalo processors in the country approved by the Ministry for Primary Industries.

There’s nothing not to like about farming water buffalo, says the family.

The animals are good natured, smart, easy calving and very hardy. Phil says he’s had the vet out only twice in eight years. They’re great converters of what dairy farmers would call “unimproved pasture”, says Annie, and clean up the rushes on the properties.

They’re long-lived – a cow can be expected to milk for 20-25 years. This means herd numbers build up fast and Phil says he could easily spare up to 30 cows today for someone wanting to enter the industry.

The family sells week-old calves for about $400-$500 and would expect to get up to $6000 for a milking cow, which can produce up to $3000 worth of milk in their first year plus a calf annually.

Water buffalo can be run with any other animal except for sheep and goats, which carry a disease fatal to them, he says. They don’t get facial eczema, probably because of their tropical origins which condition them to heat and humidity.

They can jump a standard wire fence but are very respectful of a single or two-wire electric fence.

“They’re a big solid, well-grounded animal and a little bit of electricity goes a long way,” says Phil.

“They’re easy to handle, you can pack them into the yard for milking and walk through them and never get a knock. We tie a foot down in the milking shed because they take the cups off. They don’t kick at you, and most will lift a foot for you (to tie). They can get very protective with a new calf.”

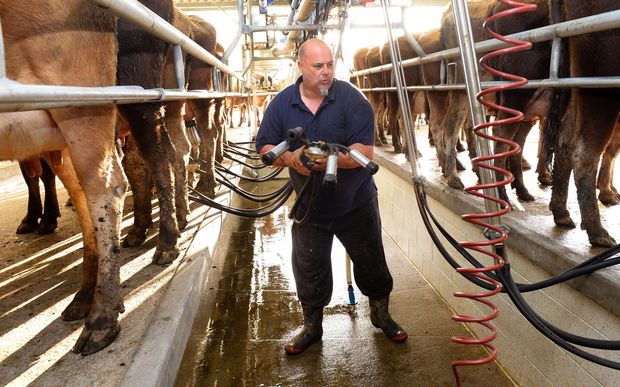

Phil milks in half a herringbone shed but is building an old-style walk through dairy shed.

“I know it means getting up and down, but it will be good particularly at this time of the year when I have new cows coming in which take a while to milk out while others that have been (milking) in for a while milk out quickly.

“The walk-through will mean they each have their own stall and can’t play with the neighbour.”

Phil milks with an old duo-vac system which starts at a low pulse and vacuum rate and builds pace.

“They hold their milk differently to a dairy cow. They hold it right up so it looks like they have a very small udder. When they start to let down it (the duo vac) changes to a higher pulse rate and higher vacuum. It gives them that time.”

The herd is fed entirely on grass. The family cuts about 70 bales of baleage a year. In the new dairy shed cows may get molasses “as a treat”, Phil says.

The herd is not drenched or vaccinated because with their broad diet of rye grass and clover, tropical-type grass, some plantain and rushes, it’s unnecessary, says Annie, a passionate advocate of the nutritional value of “unadulterated” buffalo milk and strongly critical of the dairy industry’s use of palm kernel extract as a cheap feed supplement.

Mum Pam agrees: “If cows were meant to eat PKE they’d be born with sharp teeth.”

Early lessons about farming buffalo included not offering them large water troughs – they climb in – and to make sure trees are protected.

“We always offer trees for shelter but they need to be on a fence line because they sharpen their horns and ring bark them,” says Phil.

Water buffalo need wallowing space. They will dig their own in wet ground, and in winter Phil makes available to them areas that are too wet to graze.

He’s been subdividing paddocks for easier break fencing so that in winter the big heavy animals can be moved daily to limit pugging. A stand-off pad is planned.

Chris says the family has invested about $300,000 so far in the business, including the cheese making facility. Annual revenue is $120,000 to $150,000, he says.

The aim is to utilise every part of the animal, and the next challenge is to find a New Zealand processor for the thick hide, valued overseas for handbags and shoes.

The horns are popular with bone and knife carvers and for jewellery, especially earrings.

After eight years the family can start to think about consolidating the operation.

Phil says that means focusing on genetics and being able to cull animals.

“At the moment we’re bringing a lot of young ones through. It would be nice to have four or five replacement cows a year to deal with instead of 20.”

There are two types of water buffalo – swamp and river.

The family’s herd foundation imports were a mix but breeding now leans to the river species.

Expanding the farming operation is not on the agenda.

Finding good sized pieces of land in the highly subdivided district is challenging and more animals would mean establishing a second herd just for milk production, says Phil, who is aiming to be in the milking shed less, not more.

“I don’t want to milk more than 40 at any one time. That’s a good amount of milk for cheese while remaining artisan.”

The family is keen to move more into high quality meat production which means a greater focus on bull genetics, the possibility of importing semen instead of using sire bulls, and less cheesemaking.

The aim is have calving only three months of the year. The family is keen to see Whangaripo Buffalo meat stocked in supermarkets.

They’re committed to encouraging and supporting new entrants to water buffalo farming.

“They’re an amazing animal,” says Annie.

“Buffalo milk is the way of the future, the export potential is huge including for milk powder.

“The meat is good and lean, and totally organic. You get a lot of bang for your buck.”

ABOUT WATER BUFFALO

- Contribute 72m tonnes of milk and 3m tonnes of meat a year to world food supply

- More than 130m domestic animals

- Depended on for food more than any other domestic animal

- Recommended by conservation scientists to manage uncontrolled vegetation and open clogged waterways for wetland life